Share this

Optimizing Asset Management: How Top RIAs Are Increasing Control Over Investments

by Billy Kropp on January 11, 2024

68% of Assets are Run by Advisors (Rep as Manager). Here’s How a Select Group of RIAs are Gathering More Assets into Their Own Investment Models.

In a recent webinar by Cerulli Associates, it was surprising to learn that nearly 70% of assets are managed under the Rep as Portfolio Manager structure, where advisors actively construct and make allocation decisions for client portfolios. Many of these advisors use ETFs as foundational components to create their internal models, which are then allocated to client accounts.

As the Head of Trading at UX Wealth, I have led efforts to design our technology platform in a manner that simplifies this entire process for advisors. Whether you are currently constructing your own investment models or contemplating it for the future, there are several important factors to consider.

Valuation (Building Your Own Track Record)

As business owners, many advisors are consistently seeking strategies to optimize the value of their businesses. One approach is transitioning your financial planning practice into an asset management firm. Historically, asset managers with verified track records have achieved higher multiples compared to financial planning practices. The inclusion of a live track record that is validated and certified as compliant significantly enhances the valuation. At UX Wealth, we provide comprehensive support for all documentation requirements necessary to certify your track record, simplifying what is typically a rigorous and time-consuming process for advisors.

Distribution (Marketing Your Models to Other Advisors)

Many advisors boast an impressive track record in model management and aspire to explore how their models could benefit fellow advisors across the country. The demand for outsourced model management continues to surge, and you may possess a strategy that resonates with advisors and would be a valuable addition to their offerings. We've observed that many exceptional model managers share a common challenge: getting their strategies in the hands of other advisors. UX Wealth received a nomination for Model Marketplace of the Year, and advisors nationwide utilize our platform to discover exceptional asset managers. We have a remarkable track record of curating outstanding managers and showcasing their investment models to the broader industry. Let us handle the distribution while you focus on what you do best.

Mitigating Your #1 Risk

Successful businesses excel at managing business risk, and one of the top risks in your business will always be associated with trading errors. Citing a report on their website, the law firm Golson Scruggs found that trade error claims increased by 500% during the period of March to May 2020, compared to the same period in the previous year. Navigating the right policies and procedures is a daunting task, and attempting to execute these procedures properly can seem like an exercise in futility. It appears that every week, regulators are increasingly stringent on issues such as incorrect trade executions, unfair trade allocations, and trading-related compliance errors. At UX Wealth, we have designed one of the most sophisticated trade technologies that covers all bases for advisors. We have also priced this service very competitively, making it a compelling choice for advisors seeking both adoption and protection.

Billing and Reporting

We have observed that many advisors struggle with billing and reporting, prompting us to make it a cornerstone of our support services. This often-overlooked aspect of asset management can significantly impact client relationships, revenue, and cash flows, and it can lead to audit and compliance challenges. The ability to adapt to continuous compliance regulations and manage vast amounts of data from various systems and sources is crucial. Advisors are increasingly turning to UX Wealth to outsource these vital back-office tasks. In doing so, they gain simplified control over the timing, consistency, and calculations of their custom fee structures.

Time Management With Less Stress, Embracing Technology

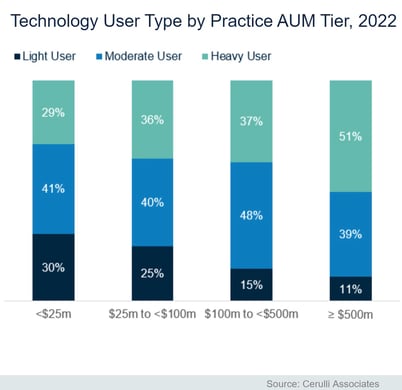

Change can be challenging, which is a key reason many advisors continue using their legacy trading, billing, and management systems. However, the evolving landscape of compliance and risk management necessitates considering change. We at UX Wealth have designed an easy and cost-effective solution to keep advisors a step ahead. According to a study by Cerulli Associates, larger AUM practices increasingly leverage technology to grow successfully. If advisors aim to scale their businesses, embracing technology becomes essential. UX Wealth Partners offers the tools and support to facilitate this growth. If you're acting as a portfolio manager for your client's portfolios, it's crucial for your business to explore how UX Wealth can enhance your value proposition.

Change can be challenging, which is a key reason many advisors continue using their legacy trading, billing, and management systems. However, the evolving landscape of compliance and risk management necessitates considering change. We at UX Wealth have designed an easy and cost-effective solution to keep advisors a step ahead. According to a study by Cerulli Associates, larger AUM practices increasingly leverage technology to grow successfully. If advisors aim to scale their businesses, embracing technology becomes essential. UX Wealth Partners offers the tools and support to facilitate this growth. If you're acting as a portfolio manager for your client's portfolios, it's crucial for your business to explore how UX Wealth can enhance your value proposition.

To truly understand how UX Wealth Partners can enhance your client outcomes, I invite you to continue the conversation with us. We’ve only just begun to explore the depth of our capabilities.

Investors should be aware that all trading involves costs, including the implicit cost associated with market impact and participation. While UX Wealth Partners strives to minimize these costs, market impact is an inherent aspect of trade execution. Achieving an execution price better than the Volume Weighted Average Price (VWAP) is a target, but not guaranteed. Past performance in relation to VWAP does not predict or guarantee similar outcomes in future transactions. Past performance is not indicative of future performance. The strategies employed to execute trades are carefully selected based on prevailing market conditions and the specifics of the order. However, there is no single strategy that is best for all situations, and outcomes can vary. UX Wealth Partners is committed to best execution. This means that while we cannot ensure the lowest possible cost in all circumstances, we constantly aim to optimize trade execution in favor of our clients. The financial markets can be volatile and unpredictable. UX Wealth Partners’ trading desk responds dynamically to changing market conditions, which can affect trade execution and outcomes. While our technology and order management systems are designed to facilitate efficient trade execution, system effectiveness is subject to market conditions, system performance, and other factors. The timing of order execution is subject to various factors, including but not limited to, order size, market liquidity, and the specifics of the client's instructions. Delays may occur despite our efforts to execute orders promptly. UX Wealth Partners regularly reviews trade execution quality to ensure consistent delivery of our service standards.